Who we are: 我們是誰

Ancient Era Insurance (遠古時代的保險)

EARLY RISK INSTRUMENTS

The earliest known instance of insurance dates back to the Babylonian period circa 2250 BC when the Babylonians developed a type of loan insurance for maritime business. Examples can be found in the Code of Hammurabi. 汉谟拉比法典 現存于羅浮宮 (中國商朝)

The first methods of transferring or distributing risk in a monetary economy were practiced by Chinese and Babylonian traders in the 3rd and 2nd millennia BC, respectively. Chinese merchants traveling treacherous river rapids would redistribute their wares across many vessels to limit the loss due to any single vessel’s capsizing. The Babylonians developed a system that was recorded in the famous Code of Hammurabi, c. 1750 BC, and practiced by early Mediterranean sailing merchants. If a merchant received a loan to fund his shipment, he would pay the lender an additional sum in exchange for the lender’s guarantee to cancel the loan should the shipment be stolen or lost at sea. England in the mid-18th-century Merchants and shipowners very largely insured their own ventures themselves, but the need for discounting facilities arose after 1750 with the growing volume of bills drawn against West Indian merchants. Thus some of the more important Liverpool merchants began to exercise the functions of banking

https://en.wikipedia.org/wiki/History_of_insurance

Modern insurance (現代保險) – 两个「日不落帝国」 · 西班牙帝国 · 大英帝国

Insurance became more sophisticated in the Enlightenment era Europe, and specialized varieties developed. Some forms of insurance developed in London in the early decades of the 17th century. For example, the will of the English colonist Robert Hayman mentioned two “policies of insurance” taken out with the diocesan Chancellor of London, Arthur Duck. Of the value of £100 each, one related to the safe arrival of Hayman’s ship in Guyana and the other was in regard to “one hundred pounds assured by the said Doctor Arthur Ducke on my life”.

Warren Buffett – (沃伦·巴菲特 BRK-A)

https://www.fool.com/quote/nyse/berkshire-hathaway-a-shares/brk-a/

Do you know how Warren Buffett makes his fortune?

https://en.wikipedia.org/wiki/List_of_assets_owned_by_Berkshire_Hathaway (Compositions)

Warren Buffett has a $128 billion cash pile. (巴菲特的1,280億美元現金儲備)

Do you like free money? 免費的錢 – 喜歡嗎?

(巴菲特 BRK-A) :(JPMorgan – 洛克菲勒):(AMZN: 贝索斯)

Haven Healthcare, a joint venture between Amazon, JPMorgan Chase, and Berkshire Hathaway, created its first offering in the form of health insurance plans for tens of thousands of employees.

Explain – how to collect insurance premium & use as free money

The amount is Vietnam GDP #44 in the world.

Why Obama #44 and Warren Buffett are suddenly best pals (奧巴馬總統和巴菲特突然變成好友)

What is Obama Care & Why (奧巴馬健保和為什麼)

https://en.wikipedia.org/wiki/Health_insurance_in_the_United_States

The reason (表面的原因)

USA – the only advanced country without Universal Health Care.

美國 – 唯一還未有全民健保的先進國家!

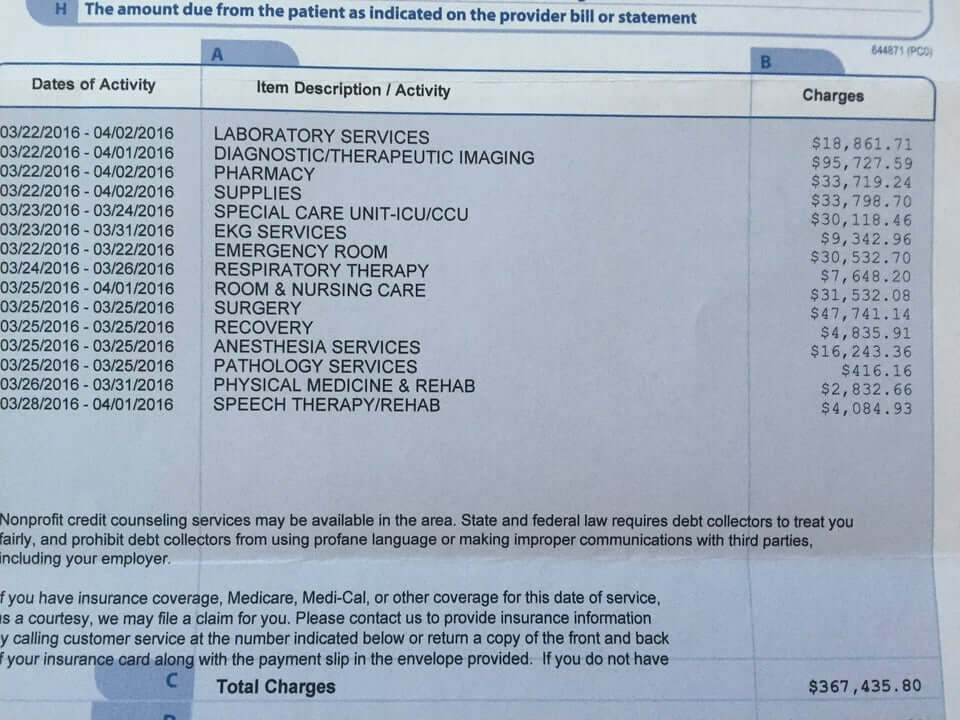

Medical Bills: The Leading Cause of Bankruptcy (昂貴的醫療費用是導致

美國人破產的首要原因)

Medical Bills: The Leading Cause of Bankruptcy in the United States. Debt is a huge problem in the United States. Whether it is from paying for school or buying a home, a large portion of American citizens owes some amount of money. Unfortunately, medical expenses are one of the reasons some people fall into debt.

從著名電影“我不是藥神”中,深刻體現出在中國如果沒有錢就等於沒有醫療,不幸得了大病,可能只能“等死”!

但在美國,即使最窮的人,身無分文也好,只要你有需要,都會先醫治你,醫療費用後續再追討,確實沒錢,就申請破產!

所以醫療費用往往是導致美國人破產的首要原因

而奧巴馬健保旨在解決此問題.

奧巴馬健保醫療改革法案

Why is the USA healthcare cost is so expensive? Free Market? (為什麼美國的醫療費用這麼昂貴?資本主義價高者得?)

USA vs. Singapore Comparison (Newsweek)

Singapore has World # 3 Hospital

https://www.newsweek.com/2019/04/05/10-best-hospitals-world-1368512.html

The population of Nanjing & #3, Similar to Singapore

Similar Doctor Education System as China (與中國醫生類似的教育體系)

A college degree, graduation from medical school, and residency are required to become a doctor alone, with additional years of experience and specialty training to become an oncologist. Licensing is mandatory, and oncologists should have certification if they have a subspecialty.

All Singaporeans and PRs get basic health insurance (MediShield Life) which covers basic public hospital treatments.

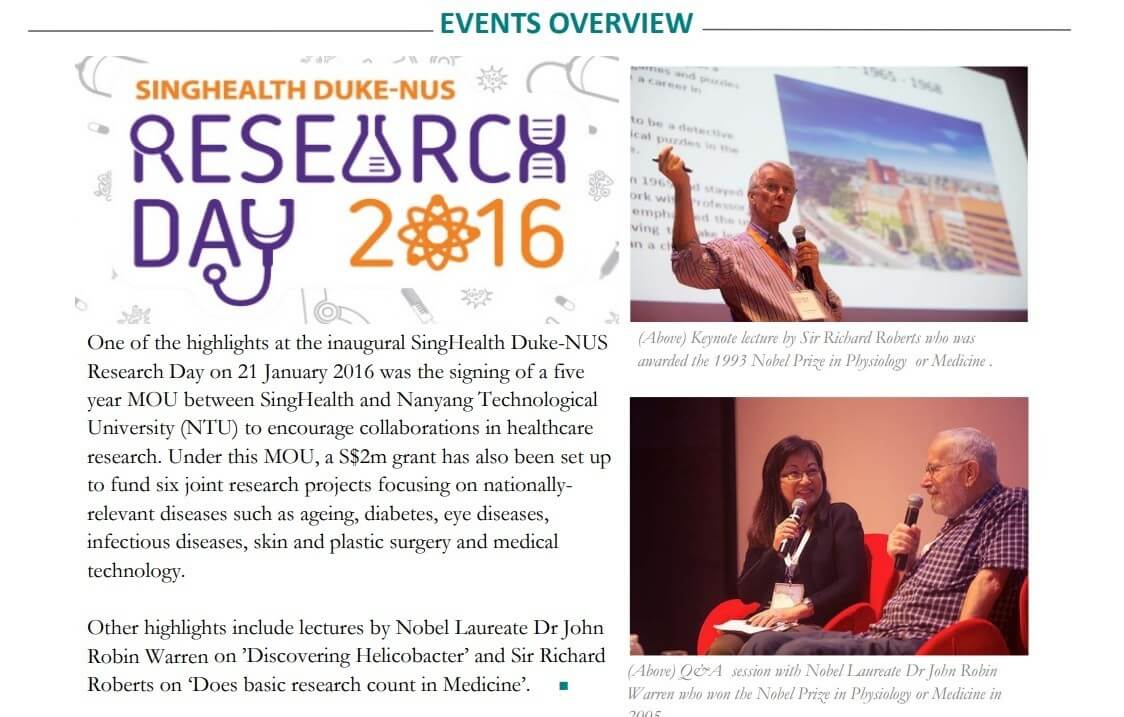

Nobel Laureate? The secret?

諾貝爾獲獎者的秘密?

Singaporean Complaint. – 4 hours wait for time新加坡人的投訴 四小時的等候時間

新加坡有很高的醫療水平,如果是當地公民,收費很便宜。所以等候時間就會比較長。海底撈的張勇不知道是否為此而移民去了新加坡呢?

Singaporean Doctor – $292,660 (SGD) Senior Level Salary

USA Doctors here make $472,000

Dr. Chen。Stanford University: Why being a doctor in America is better than UK

https://www.quora.com/Is-being-a-doctor-in-America-better-than-being-a-doctor-in-the-U-K

Nobel Laureate

2017 – Jeffrey c. Hall; Michael Morris Rosbash; Brandeis University ;

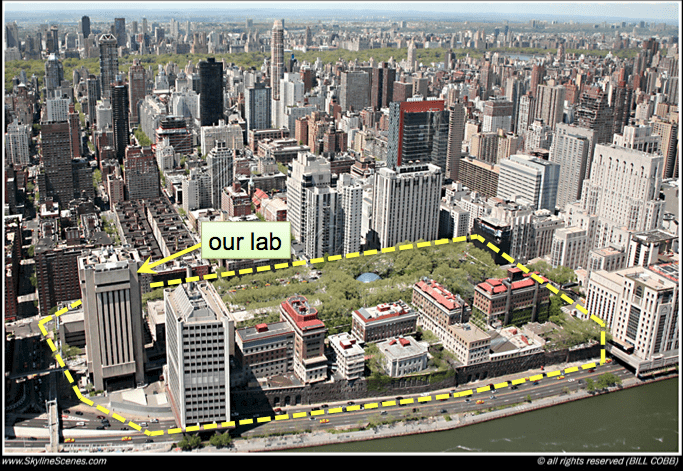

Jeff Hall Rockefeller University to MSK

As of October 2019, a total of 36 Nobel laureates have been affiliated with Rockefeller University. Japan has 28

2018 James P. Allison (MD Anderson) & Tasuku Honjo (Shared 2018 Nobel Prize of Medicine)

2019 William G. Kaelin (Dana–Farber Cancer), Gregg L. Semenza (John Hopkins), Peter J. Ratcliffe Oxford University

全球最好的癌症醫院 (百度)

The aftermath of ObamaCare… No more PPO insurance (一分價錢一分貨)

With PPO insurance, you can go to any hospital like MSK, MD Anderson.

你需要好的保險計劃去看好的醫生