紐約團體保險的有效豁免可能因保險公司和具體的保單而異。然而,

保費豁免:此豁免允許員工停止支付其保險單的保費,

配偶豁免:此豁免允許員工拒絕為其配偶提供保險,

退出豁免:此豁免允許員工完全拒絕保險,

雙重保險豁免:

家屬豁免:此豁免允許員工拒絕為其家屬提供保險,

需要注意的是,并非所有保險公司都提供這些具體豁免,

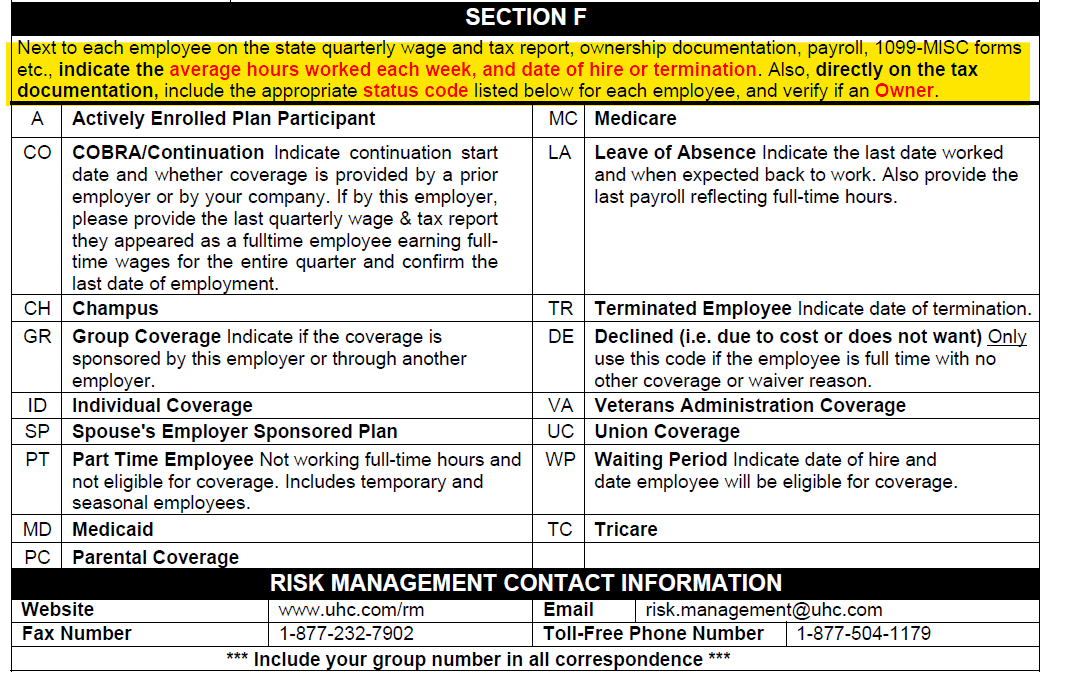

The specific valid waivers for group insurance in New York may vary depending on the insurance company and the specific policy being offered. However, some common valid waivers for NY group insurance may include:

Waiver of premium: This waiver allows an employee to stop paying premiums on their insurance policy if they become disabled and unable to work.

Spousal waiver: This waiver allows an employee to decline coverage for their spouse if the spouse has other insurance coverage.

Opt-out waiver: This waiver allows an employee to decline coverage entirely if they have other insurance coverage.

Dual coverage waiver: This waiver allows an employee to decline coverage under one plan if they are covered by another plan.

Dependent waiver: This waiver allows an employee to decline coverage for dependents if the dependents have other insurance coverage.

It’s important to note that not all insurance companies may offer these specific waivers, and the terms and conditions of each waiver may vary. It’s always a good idea to carefully review the policy and speak with an insurance representative to fully understand the available options and potential implications of any waivers.

Valid waivers for NY group are still the same: Spousal, Medicare, Medicaid, Veteran and Parental coverage. Other waivers are Non-valid waivers.